This article by Garry Stasiulevicuis needed to be published. It is important for so many reasons that should be blindingly obvious. The charts and images shown are of deep concern.

In the world of travel retail, brands are told – often in no uncertain terms – that investment in branded furniture is the ticket to visibility and sales. Retailers expect it, trade agreements often mandate it, and brands comply – pouring substantial budgets into high‑quality, purpose‑built displays that are designed to attract, inspire, and convert shoppers.

But a quiet crisis is unfolding on the shop floor: these investments are being undermined by poor retail standards, with branded displays increasingly housing products from competing suppliers. This “brand encroachment” doesn’t just look messy, it corrodes brand trust, confuses shoppers, and reduces conversion rates. And in a market where every percentage point matters, the financial implications are staggering.

According to Garry, one Managing Director of a leading brand owner summed it up bluntly:

“It’s simply not on! If this was Chanel it just wouldn’t happen — they wouldn’t let it!”

And he’s right. This is a problem area that needs fixing. Does ROI now mean Return on Ignorance? Please read on…

The Deal: Branded Displays as a Strategic Investment

In travel retail, the retail‑brand partnership has always been clear:

Retailers demand investment in fixtures as part of trade agreements.

Brands respond by funding, designing, and delivering bespoke display furniture tailored to the store’s environment.

In return, the fixtures provide a dedicated showcase for that brand’s products – a branded “beacon” intended to drive shopper engagement and sales.

These displays are not cheap. Beyond manufacturing and installation, brands pay for creative design, and ongoing maintenance. Add retailer investment such as listing fees, and the sums soon hit eye watering amounts. The return on that investment is supposed to come from shopper conversion.

These fixtures are designed to attract travellers into the store, turn a browser into a buyer and encourage the shopper to spend more before they head to the till.

But for too many brands, the reality is that their carefully curated fixtures are being misused, often becoming a dumping ground for competitors’ products or stray inventory.

The Scale of the Problem: Hard Data on Brand Encroachment

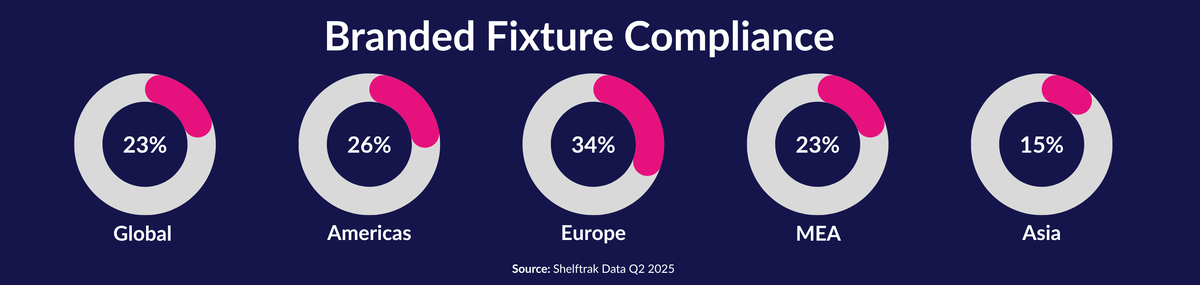

Shelftrak analysis of 995 branded confectionery fixtures across approximately 70 global travel retail stores reveals that nearly 23% of branded displays contain competing supplier products.

The problem is not evenly spread. Compliance levels varies by region:

Europe: worst offender, with 34% of branded fixtures compromised.

Asia: 15% — still significant, but less prevalent.

Americas: around 26%.

MENA: also around 23%.

For one top‑four supplier in Europe, the figure is shocking – 62% of their branded displays contain competitor products.

Some brands are disproportionately affected:

Nestlé, Guylian, and Haribo see almost 30% of their fixtures containing other brands.

Mondelez performs best, but still finds 16% of their branded displays infiltrated by competitors’ products.

The Shopper Impact: Confusion, Frustration, and Missed Sales

To a time‑pressed traveller, branded displays are a shortcut to decision‑making. They signal, “Everything you want from Brand X is right here.” When that promise is broken, three damaging things happen:

Trust is eroded – Shoppers expect authenticity. Seeing unrelated brands in a “dedicated” space undermines credibility and suggests disorganisation.

Browsing becomes harder – Mixed‑brand displays break visual coherence. Shoppers must work harder to find what they’re looking for.

Conversion drops – Confusion slows decision‑making. In a mission‑driven, time‑sensitive environment like an airport, many shoppers simply walk away.

Instead of driving sales, the branded fixture becomes just another generic shelf, losing the very differentiation it was built to achieve.

The Commercial Cost: ROI in Freefall

Let’s be blunt: poor fixture compliance destroys ROI.

These fixtures are expensive capital investments. Every day they’re misused, the intended return is diluted. Worse still, the beneficiary of that investment may be a competitor whose products are piggy‑backing on premium real estate they didn’t pay for. The likely outcome, lost sales that impact both retailer and supplier.

Our conservative estimate: at least 10% more sales are being missed daily in confectionery travel retail due to poor execution – and that’s before factoring in other basic failings such as missing or incorrect pricing.

An Industry of High Rhetoric, Low Discipline

Travel retail never tires of telling itself that it’s about experience, engagement, and adapting to changing shopper behaviours. But while we talk endlessly about digital innovation, experiential activations, and “the store of the future”, we are failing on the most basic in‑store disciplines.

The reality is simple:

If we can’t keep branded fixtures compliant…

If we can’t ensure correct pricing…

If we can’t guarantee availability on core SKUs…

…then all the talk about “transforming the shopper journey” rings hollow.

Retail Operations Are Hard — But That’s No Excuse

To be fair, running retail operations in a travel retail environment is challenging.

Stock management issues, staffing shortages and replenishment bottlenecks all contribute to compliance failures. It’s easy to see how a store team under pressure might fill an empty space on a branded display with another brand’s product “just for now.”

But here’s the truth: “just for now” often becomes weeks. And while operational pressures are real, they don’t negate the obligation to respect brand investments and protect the integrity of the shopper experience.

The Shared Responsibility: Retailers and Brands Must Act

Fixing this is not about retailers versus brands, it’s about retailers and brands working together with shared accountability.

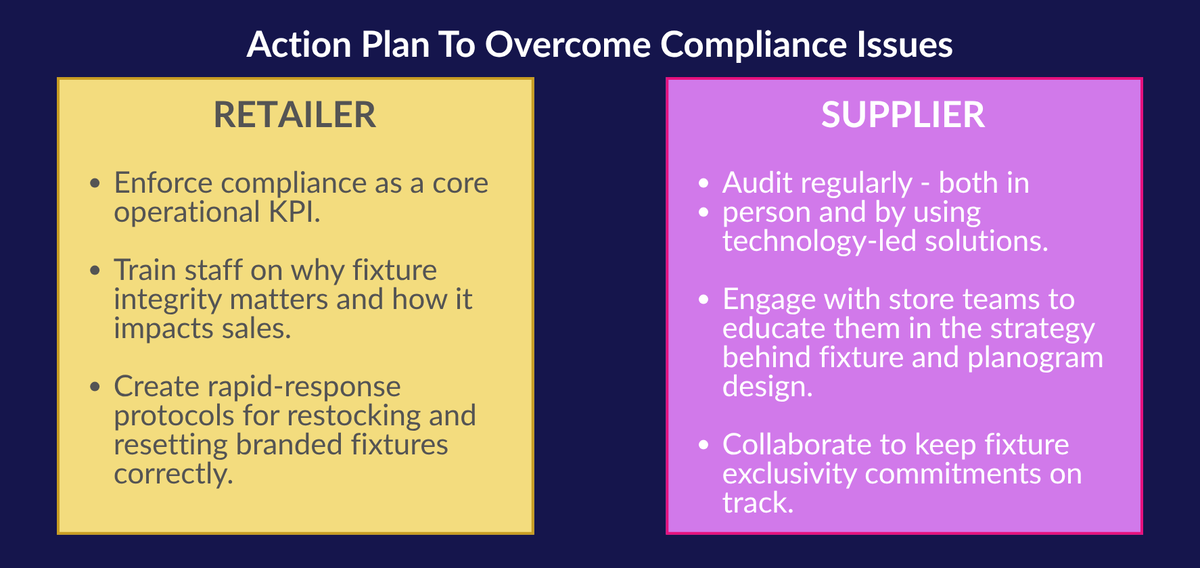

Retailers should:

Enforce compliance as a core operational KPI, not a nice‑to‑have.

Train staff on why fixture integrity matters and how it impacts sales.

Create rapid‑response protocols for restocking branded fixtures correctly.

Brands should:

Audit regularly – both in person and by using image‑recognition compliance tools.

Engage with store teams to educate them in the strategy behind fixture and planogram design.

Collaborate with retail partners to keep fixture exclusivity commitments on track.

In other words: measure it, share it, fix it.

Lessons from Luxury: Chanel Wouldn’t Stand for It

The confectionery sector could take a page from luxury beauty’s playbook.

Imagine walking into a travel retail store and finding Dior lipsticks on a Chanel counter. It wouldn’t happen. Luxury beauty brands have trained the industry – and store staff – to understand that branded fixtures are sacrosanct.

Confectionery brands deserve the same respect. If the sector wants to position itself as a premium category with high‑value shoppers, then fixture integrity must be non‑negotiable.

From Rhetoric to Reality: The Growth Opportunity

Fixing brand encroachment isn’t a “nice improvement”, it’s a tangible growth lever.

Based on current analysis, simply maintaining compliance could lift category sales by 10% at least and up to 18% (Based on our findings at Shelftrak).

Combine that with addressing other basic execution gaps – pricing, planogram compliance, availability, and the potential upside is even higher.

In a channel that prides itself on “premiumising” categories, it’s absurd to leave that much value on the table because of sloppy fixture discipline.

The Call to Action

Confectionery in travel retail is a powerful category. It’s high‑volume, high‑margin, and emotionally resonant with shoppers. But its performance is being undermined by basic execution failures.

Retailers and brands must:

Acknowledge the problem – stop treating fixture misuse as a minor issue.

Commit to fixing it – make compliance a shared operational and commercial priority.

Hold each other accountable – with data, audits, and transparent reporting.

If we do this, we protect brand equity, respect investment, and unlock meaningful sales growth.

Because here’s the bottom line:

Every branded fixture that houses a competitor’s product is a silent sales assassin that is killing ROI, corroding trust, and making a mockery of the brand‑retailer partnership.

Again, and in the words of that frustrated brand MD:

“It’s simply not on! If this was Chanel it just wouldn’t happen — they wouldn’t let it!”

It’s time confectionery travel retail adopted the same standard.

To subscribe free, please enter your email address: